Turning 26 and Your First Plan

Turning 26 is a milestone birthday when it comes to health insurance because you're no longer eligible to stay on your parents’ health plan.

However, turning 26 is considered a qualifying life event—which makes you eligible (qualifies you) to buy health insurance during a special enrollment period. This special enrollment period lets you choose coverage right away, helping you avoid a coverage gap (a period where you're not covered by health insurance and would have to pay full price for healthcare services, including medical emergencies).

Please note: There are other events you may experience throughout your life—like having a baby, getting married or losing health coverage—that qualify you for a special enrollment period. Learn more about other qualifying life events.

Special Enrollment Period

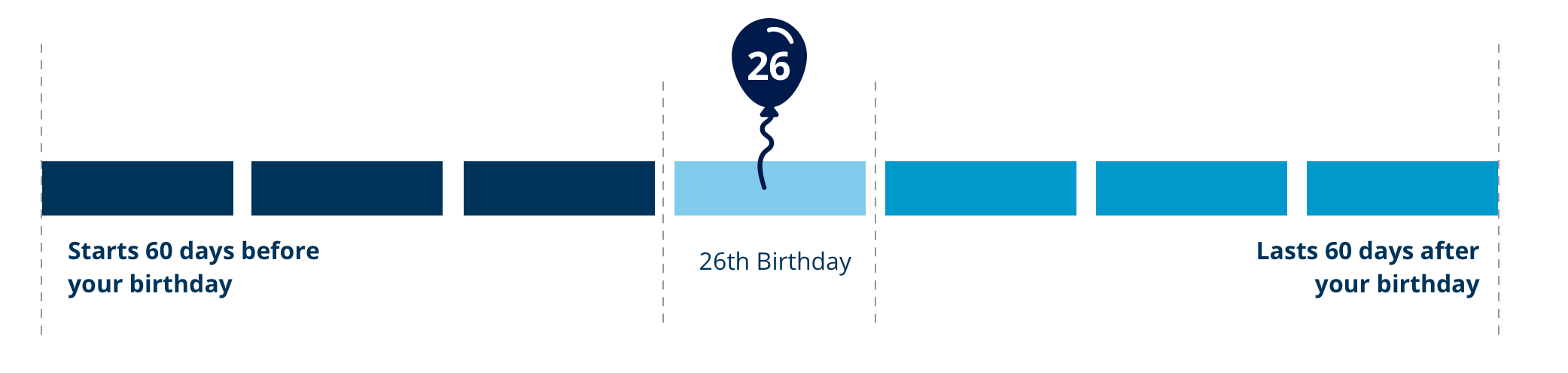

Your special enrollment period for choosing a health insurance plan is a 4-month window, which includes:

- The 60 days before your 26th birthday,

- your 26th birthday, and

- the 60 days after.

What if my parents have private health insurance through their employer?

The employer decides when your coverage under their plan ends. For example, this could be the last day of your birth month or the end of the calendar year. Ask your parents to either check their employee handbooks or ask their HR department when your coverage will end. You and your parents can also contact the health insurance company to ask when coverage ends.

What if I've been covered by my parents' Affordable Care Act (ACA) plan?

Your coverage will not end until the last day of the calendar year. However, you can purchase your own health insurance during open enrollment, which is most likely between November and the end of January (this may vary depending on the Market/Exchange).

Best Health Plans for Young Adults

Choosing health insurance for the first time can be overwhelming, but with the right information, you can make a confident choice.

You can apply for a Marketplace insurance plan in Northern Virginia, Washington, D.C. and Maryland. The Marketplace offers a variety of plans with many levels of coverage and price points.

Depending on your income, you may be eligible for financial assistance. Applying for a Marketplace plan will also tell you if you qualify for Medicaid.

All health plans are required to offer coverage regardless of a pre-existing condition such as diabetes, depression or pregnancy.

If you have a job that offers a health insurance plan, ask your HR department how to enroll before you turn 26. Like ACA plans, employer-sponsored plans are required to cover pre-existing conditions and will not deny you coverage.

A high deductible health plan is a plan with a higher deductible (the amount you must pay out of pocket before your insurance kicks in) than a traditional health plan. Designed for young, relatively healthy adults who don't need much coverage but want to protect against high medical emergency costs—high deductible health plans generally have the lowest monthly payments in exchange for the highest out-of-pocket costs.

If you’re enrolled in a high deductible health plan, you can qualify to get a health savings account (HSA), which you can use to pay for your deductible and qualifying medical expenses, using money that’s not taxed as income. You can also use it as a savings vehicle for future healthcare expenses.

It may be a good idea to combine an HSA with a high deductible health plan if any of these are true:

- You have predictable healthcare expenses.

- Your employer contributes to your HSA, leaving a smaller out-of-pocket payment than the amount you would pay with a lower deductible health plan that did not use your HSA.

- You want to save money now, tax-free, for health expenses when you are older.

If you live in Maryland, Washington D.C. or Northern Virginia, check out CareFirst's affordable, high-quality health insurance plan options to find out which plan works best for you.